owner draw report quickbooks

In the ACCOUNT column enter Owners Equity or Partner Equity. 2 Create an equity account and categorize as Owners Draw.

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

In the Account field be sure to select Owners equity you created.

. Select Equity and Continue. Owners equity is also where a family living or draw account would be located if the business is providing for personal needs of the owners and an. An alternative to recording a payment in quickbooks is to create a journal entry.

People who searched pasiones tv novelas also searched 8Q Las mejores novelas turcas en español gratis disfruta de tus series y telenovelas. Here are few steps given to set up the owners draw in QuickBooks Online. Now hit on the Chart of Accounts option and click new.

Then choose the option Write Checks. In the Write Checks box click on the section Pay to the order of. At the bottom left choose Account New.

Select Print later if you want to print the check. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. In this section click on the Owner.

Choose Lists Chart of Accounts or press CTRL A on your keyboard. Fill in the check fields. Navigate to Accounting Menu to get to the chart of accounts page.

In the drop-down of Account type you. The draw is a way for an owner to receive money from the. The transactions in these accounts are compared with your quarterly or monthly tax payments and validated against your Profit and Loss and Balance Sheet reports.

From the Accounts Drop Down menu select the bank account in which you want. Open the QuickBooks Online application and click on the Gear sign. To create an owners draw account.

Owner draw report quickbooks Monday March 7 2022 Edit. The best way to do it would be to go back and change the expense account from Owners Personal Expenses to Owners Draw equity account for each transaction if there arent a prohibitively high number of them. In QuickBooks Desktop software.

Choose the bank account where your money will be withdrawn. To Write A Check From An Owners Draw Account the steps are as follows. In the window of write the cheques you need to go to the Pay to the order section as a next step.

We also show how to record both contributions of capita. At the upper side of the page you need to press to New option. Click Save Close.

Select Chart of Account under. Visit the Lists option from the main menu followed by Chart of Accounts. Click Equity Continue.

QuickBooks records the draw in an equity account that also shows the amount of the owners investment and the balance of the owners equity. Navigate to the Account Type drop-down and select the Equity tab. Now you need to choose the owner and enter an amount next to the currency sign.

First you can view the accounts balances by viewing their register. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. Steps to record owner investment in quickbooks.

The memo field is optional. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to. When entering a check written to the owner for personal expenses post the check to her draw.

Smith Draws Post checks to draw account. A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online.

With our Owner Salary or Draw Posting Service your accountant reconciles your self-employment expenses owner equity and tax liability account distributions each month. A clip from Mastering. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks.

Click on the Banking menu option. Expenses VendorsSuppliers Choose New. In fact the best recommended practice is to create an owners draw.

Setting Up an Owners Draw. Enter and save the information. At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Write Checks from the Owners Draw Account. Select New.

You may find it on the left side of the page. Click on the Banking and you need to select Write Cheques. First of all login to the QuickBooks account and go to Owners draw account.

Click on icon Select Bank Deposit. Before you can record an owners draw youll first need to set one up in your Quickbooks account. Here are some steps.

Select the Owners Equity and. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership name Equity do not post to this account it is a summing. 1 Create each owner or partner as a VendorSupplier.

Now enter the amount followed by the symbol. The second way to view the balance is to run the Balance Sheet Report scroll down to the Equity section and youll see the sub-accounts from there along with their. Below are the steps to Record Owner investment in quickbooks.

It appears in the register on printed checks and on reports that include this check. Enter the account name Owners Draw is recommended and description.

How Can I Run An Owners Draw Report To See The T

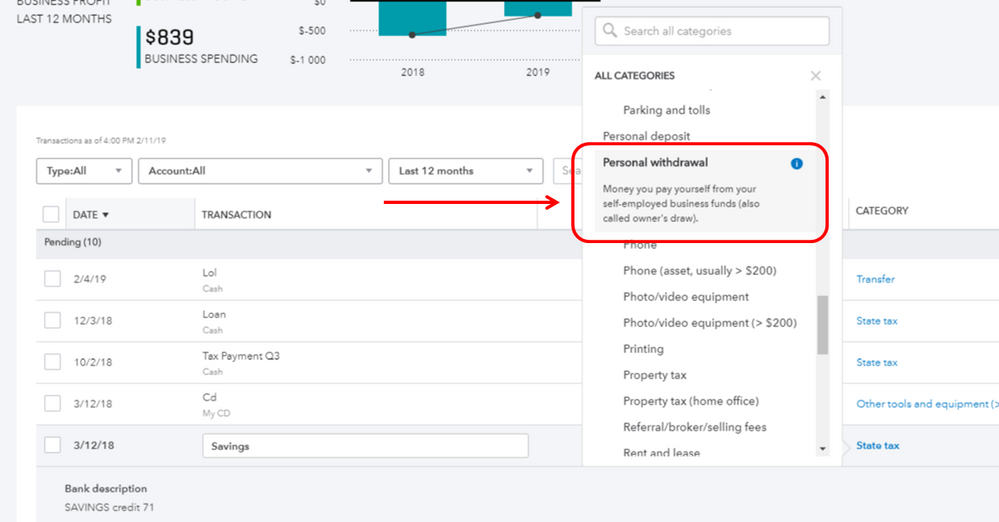

Solved Owner S Draw On Self Employed Qb

Equity Account Showing Up In Budget

How To Record Owner Investment In Quickbooks Updated Steps

Quickbooks Online Essentials With Online Payroll 2015 Recomended Products Quickbooks Online Quickbooks Small Business Accounting Software

How To Pay Invoices Using Owner S Draw

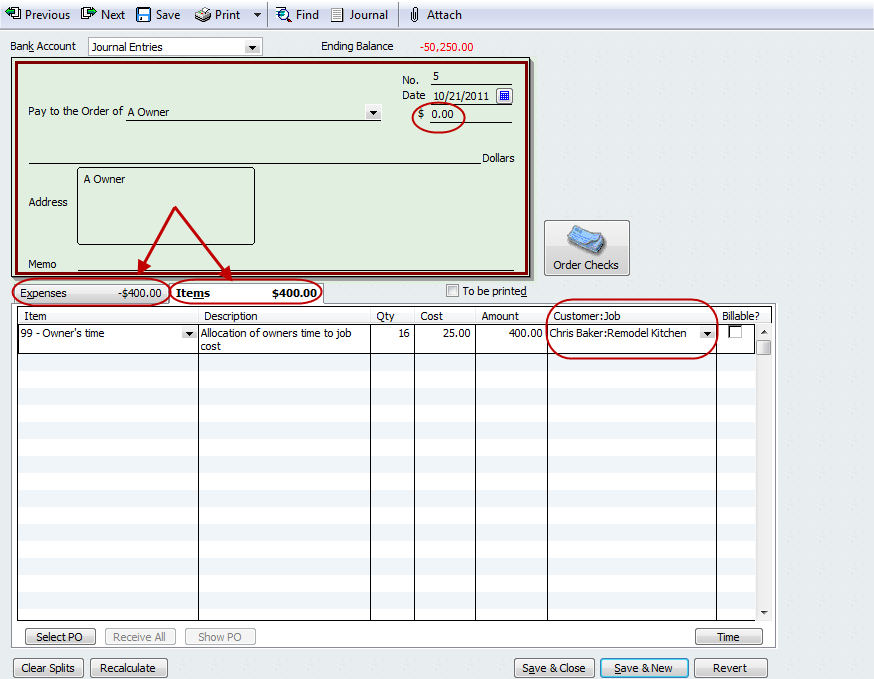

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Learn How To Record An Owner S Draw In Intuit Quickbooks Desktop Pro 2022 A Training Tutorial Youtube

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

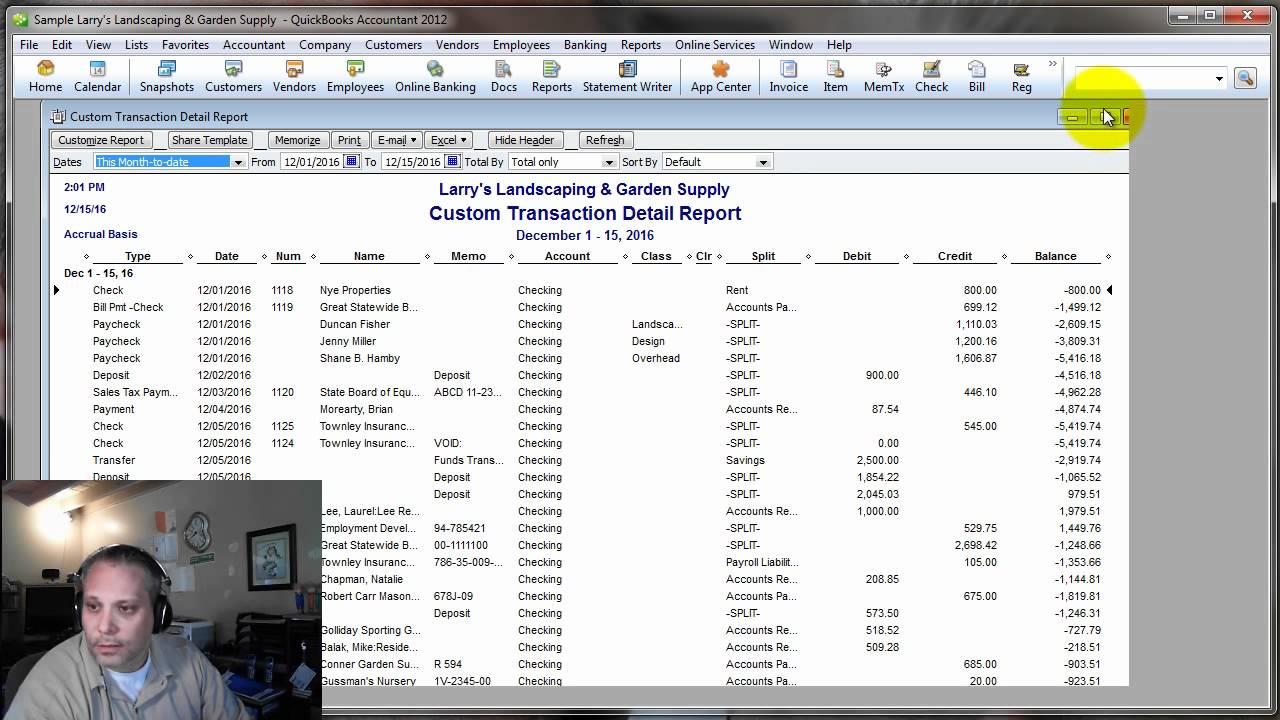

Quickbooks Help How To Create A Check Register Report In Quickbooks Youtube

Quickbooks Owner Draws Contributions Youtube

Payroll Services Pricing Payroll Quickbooks Payroll Payroll Taxes

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Salary Business Owner Business

How To Create A Balance Sheet In Quickbooks Online

How To Record Owner Investment In Quickbooks Updated Steps

Think Of The Undeposited Funds Account As An Envelope Where You Keep Checks The First Time You Receive Payments Use A Payment Quickbooks Fund Accounting Fund